As the digital age surges forward, the world of cryptocurrencies has burgeoned into a realm of possibilities, intrigue, and lucrative investments. Among these opportunities, mining machines stand out as essential tools that allow individuals and businesses alike to tap into the ever-growing potential of blockchain technologies. Understanding the relationship between mining machines and cryptocurrency rewards is vital for anyone considering an investment in this fascinating field.

At the heart of cryptocurrency mining lies the process of validating transactions on a blockchain network. This complex task is carried out by miners—powerful computers equipped with specialized hardware designed to solve intricate mathematical puzzles. The cryptocurrency landscape is diverse, with notable players like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) dominating the market. Investing in mining machines isn’t just about ownership; it’s about harnessing this technological marvel to generate rewards in the form of cryptographic tokens.

When people think of mining, the first image that often comes to mind is Bitcoin, the pioneering cryptocurrency that propelled this entire revolution. Bitcoin mining comprises a competitive landscape wherein miners vie to be the first to solve cryptographic puzzles, earning the coveted reward of newly minted BTC along with transaction fees. This process not only bolsters the security of the Bitcoin network but also plays a crucial role in regulating the coin’s supply. As more miners enter the race, the stakes heighten, necessitating more efficient mining rigs that can deliver higher hash rates.

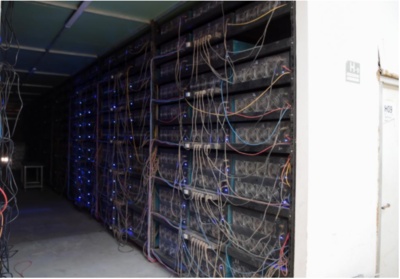

However, the realm of mining isn’t restricted solely to Bitcoin. Ethereum, the second-largest cryptocurrency by market capitalization, has seen a shift towards proof-of-stake consensus, but mining remains relevant within its ecosystem, particularly for Ethereum Classic (ETC). Investors interested in digging deeper into the mining landscape may consider hosting their machines at dedicated facilities. Mining machine hosting services provide the benefit of professional management, reduced electricity costs, and optimal cooling solutions, creating ideal conditions for maximizing profitability.

Moreover, Dogecoin has carved out a unique niche in this space. Initially conceived as a joke, Dogecoin has captured the hearts of many and has shown resilience against market volatility. Mining Dogecoin is typically less intensive than Bitcoin and Ethereum, meaning that entry-level mining rigs could still yield substantial rewards owing to its unique proof-of-work model. Those entering the Dogecoin mining sphere can diversify their portfolios while enjoying a more accessible gateway to cryptocurrency rewards.

The choice between owning a mining rig or opting for hosting solutions is pivotal, often influenced by personal circumstances and goals. For those with the capital to invest in comprehensive setups, building a personal mining farm can be thrilling. This approach allows miners to tailor their operations based on individual preferences—whether that involves cooling systems, hardware selection, or power consumption strategies. Conversely, hosting services cater to investors who prefer a hands-off approach or those who may live in regions where electricity costs could hinder profitability.

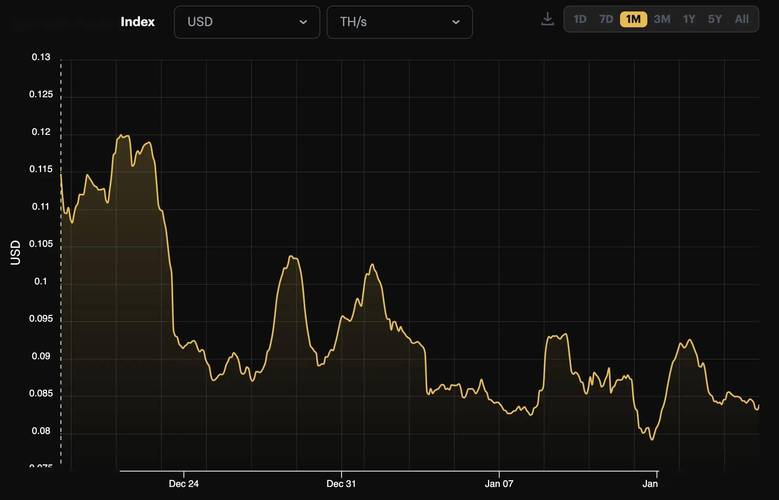

Regardless of the approach, it’s crucial for investors to stay informed about market trends, updates, and technological advancements. The cryptocurrency market is notoriously dynamic; values can surge and plummet, influenced by regulatory changes, technological innovations, or shifts in public sentiment. With this in mind, ensuring that mining rigs remain competitive with the latest hardware becomes imperative. The rapid evolution in mining technology means that staying ahead of the curve can significantly enhance your return on investment.

Ultimately, as you embark on this journey into the world of crypto mining, consider the environmental impact as well. The energy consumption related to mining has garnered scrutiny, and mining farms are exploring renewable energy sources as a means to mitigate their carbon footprint while improving sustainability practices. As the dialogue around ecological responsibility in crypto persists, integrating green solutions into mining operations will not only enhance profitability but also align ventures with growing consumer interest in sustainability.

The potential returns on cryptocurrency investments through mining have never been more promising. Each step taken in selecting the right equipment, understanding market dynamics, and engaging with the community positions your venture for success. Whether your sights are set on Bitcoin, Ethereum, or even the whimsical Dogecoin, the world of mining machines opens up a vast landscape of opportunities ripe for exploration.

“Mining Machine Investment 101” serves as an essential guide for aspiring investors. The article deftly navigates the complexities of mining technology, risk management, and market trends, providing readers with insightful strategies to maximize cryptocurrency rewards. Its engaging tone and actionable tips make it an invaluable resource for both novices and experts alike.