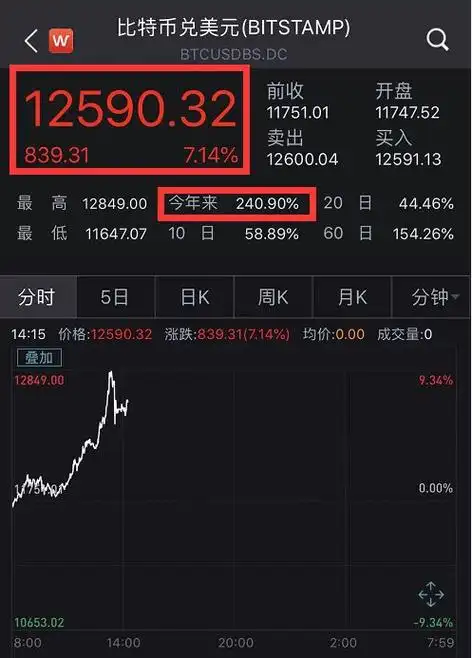

In the ever-evolving landscape of cryptocurrencies, the pursuit of efficient mining has become more crucial than ever. With Bitcoin leading the charge, the conversation around mining machines, especially ASIC miners, is continuously shifting. In an era where energy consumption is a hot topic, it’s pertinent to explore how various cryptocurrencies stack up against Bitcoin in terms of energy-efficient mining solutions.

Bitcoin mining requires specialized ASIC (Application-Specific Integrated Circuit) devices designed to handle the complex hashing algorithms associated with the Bitcoin network. These heavyweights, while powerful, often lead to significant energy expenditures. Yet, they are not the only contenders in the ring. Ethereum (ETH), once solely reliant on proof-of-work, is transitioning towards proof-of-stake, which hints at fascinating possibilities for miners seeking more energy-efficient operations in the future.

The demand for energy-efficient mining machinery has surged as cryptocurrency values fluctuate and regulations tighten surrounding energy consumption. Miners are now keenly aware that while Bitcoin may dominate, coins like Dogecoin (DOG) and newer entrants offer unique opportunities and often, more manageable energy footprints. The appeal of mining these diverse currencies lies in the balance of profitability and sustainability.

For those who favor Dogecoin, the mining process is far less taxing compared to Bitcoin. With its Scrypt algorithm, miners utilizing GPUs can join the fray. This opens the doors for smaller-scale miners who may not have the resources for extensive ASIC rigs. Moreover, the Dogecoin community has embraced a fun-loving, grassroots approach to mining that contrasts with Bitcoin’s high-stakes game.

Meanwhile, Ethereum’s transition to proof-of-stake has reinvented the mining narrative. Miners looking for Ethereum alternatives are now exploring the world of coins like Cardano and Solana, both of which promise more efficient consensus mechanisms. For miners, this shift signifies a diversification of the mining portfolio, seeking not just profitability but also energy efficiency and sustainability.

The conversation is not solely confined to coins like Bitcoin, Ethereum, and Dogecoin; it extends into the realm of mining farms. These large-scale operations often find themselves navigating the intricacies of energy consumption carefully. Energy costs can spiral, diminishing return on investments, especially when using traditional mining machinery. Therefore, the advent of low-energy ASIC miners presents an appealing solution, providing a semblance of balance in energy being expended versus returns garnered.

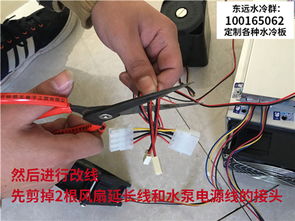

In the quest for lower energy consumption, mining farms are investing in advanced cooling technologies and renewable energy sources to power their operations. This aligns with the broader push toward sustainability sought across industries. The juxtaposition of higher energy needs in Bitcoin mining against the strategic shifts in alternative cryptocurrencies creates a rich tapestry of opportunity.

As miners reflect on their choices, the significance of selecting the right mining rig becomes apparent. In a market crowded with options from various manufacturers, understanding the hardware’s energy efficiency becomes critical. Some miners are even considering hosting their machines in facilities optimized for cooling and energy management, thus maximizing their operational efficacy while minimizing their carbon footprint.

The future is unfolding in various dimensions for miners, particularly those focused on Bitcoin versus other cryptocurrencies. With advancements continually reshaping the industry, it becomes imperative to remain informed and proactive. Staying updated on the latest in ASIC miners, hosting solutions, and changes in cryptocurrency dynamics ensures that every miner, whether focusing on Bitcoin or exploring the vibrant world of alternative coins, can optimize their investment.

This article offers a comprehensive analysis of low-energy ASIC miners, contrasting their efficiency in Bitcoin mining with alternatives in the broader cryptocurrency landscape. It explores energy consumption, profitability, and technological innovations, providing valuable insights for eco-conscious investors. A must-read for anyone navigating the evolving mining sector!